A little over two years ago I wrote a blog piece on Early Stage SaaS Unit Economics which outlines LTV/CAC for enterprise software businesses. While heavy on math, the post lacked foresight because I now believe LTV/CAC calculations are of waning importance in SaaS. It is clear to the SaaS community that the future of selling software is bottoms-up. Great examples of this today are Twilio, Shopify, Dropbox, Zoom, Slack, Square and Atlassian. A confluence of factors led to this including rapid product development and deployment via AWS, and now simply an expectation of buyers to purchase software this way.

Due to the change in selling and retention motions inherent in these models, the market has come to believe that the best way to analyze these businesses is on a cohort gross margin payback basis and not LTV/CAC. The challenge with LTV/CAC is that it’s too static of a formula to analyze businesses that are now dynamic across cohorts on all of the important SaaS metrics and variables (ARR, CAC, churn, up-sell, etc).

Let me first describe the traditional and new SaaS business models side-by-side, as the nuance between them helps to explain why the way we analyze SaaS businesses is changing.

The traditional model

The traditional SaaS business model is relatively static across the two primary variables that are captured in the LTV/CAC analysis. The go-to-market cost is captured in CAC, and the resulting gross margin lifetime schedule (a derivative of ARR) is captured in LTV. As outlined in my original post referenced above, you generally want this formula to produce a number larger than 3x. As mentioned in my prior post, I generally use 4–5 years as a customer lifetime assumption for an enterprise business (SMB is ~3 years). This means that in dissecting this formula you’d expect a customer to produce cumulative gross margin of at least 3x CAC in a 4–5 year period. Month-to-month and quarter-to-quarter, you generally don’t see that 3x LTV/CAC number bouncing around too much in legacy SaaS businesses, although you obviously want to see steady improvements over time.

The reason for this is that the traditional enterprise SaaS model employs a relatively rigid sales machine, with a relatively rigid cost structure — a marketing automation strategy sends MQLs from the top of the funnel to a team of BDRs and AEs who turn MQLs to SQLs and then hopefully paying customers. In general, you do not see legacy enterprise software deals closed without customers touching the sales team and that’s in large part because the products weren’t built to sell themselves. Legacy products are more complex in nature and require an on-boarding effort with the customer success team. Because of this structure, you generally don’t see a dramatic variance in CAC due to the fixed cost and process. On the other end of the equation looking at LTV, traditional enterprise deals are sold in annual increments. At the one-year mark, the contract either churns, down-sells or up-sells; you won’t usually see a change in the middle of the contract or a dramatic movement with the down/up-sells. Given this dynamic, once a SaaS business has a good sense of the total CAC cost, they will disqualify customers falling in an ACV band that produces an LTV of less than 3x (there is sometimes an exception here if you sell into one division of a very large org and you believe you can up-sell across the entire company over time). You’ll frequently hear legacy software founders say, “we do not sell to customers below $X thousand in ACV because they’re not profitable”. This is the consequence of having a static CAC and a product that generates a relatively static ACV and won’t drastically change in the middle or end of contract.

The new model

Now let’s switch gears to bottoms-up SaaS models such as Atlassian and Square. Starting with GTM where there is no longer a fully staffed sales team converting MQLs to SQLs and close by navigating the large organizations they’re trying to sell into. These SaaS products are designed to be sold through a website and/or inside of the core product where software can be deployed on a self-serve basis. Given this dynamic, the key GTM priorities are filling top of funnel with high quality users and iterating on landing pages + product so that conversions are optimized (much like a consumer business). Given this dynamic, bottoms-up SaaS products are now available to a wider range of customers from consumer to SMB and very large enterprise (Box and Dropbox are great examples of this). As such, the bottoms-up revenue models differ substantially from legacy enterprise software vendors.

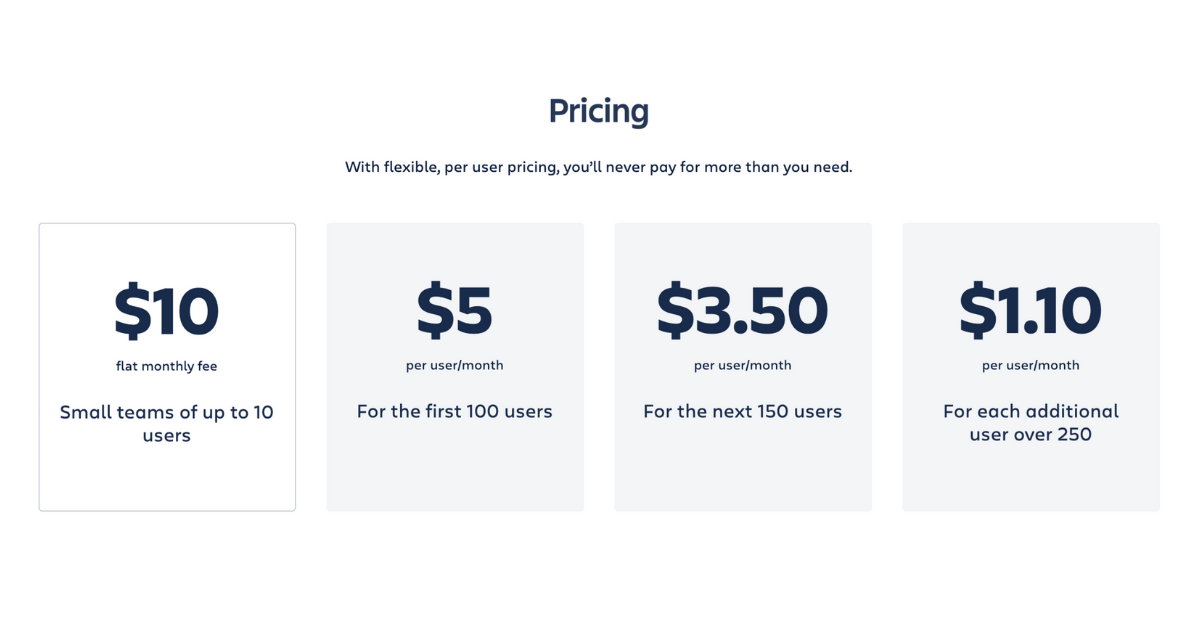

There are two primary approaches to pricing a bottoms-up model: volume-based pricing and module-based pricing. With volume-based pricing, your ARR increases period-to-period based on how much a customer is consuming (either by seats or usage). Atlassian’s Confluence (screenshot above) is a great example of this as they charge per seat with price breaks on volume. As your team size increases or decreases each month, so does your monthly payment to Atlassian.

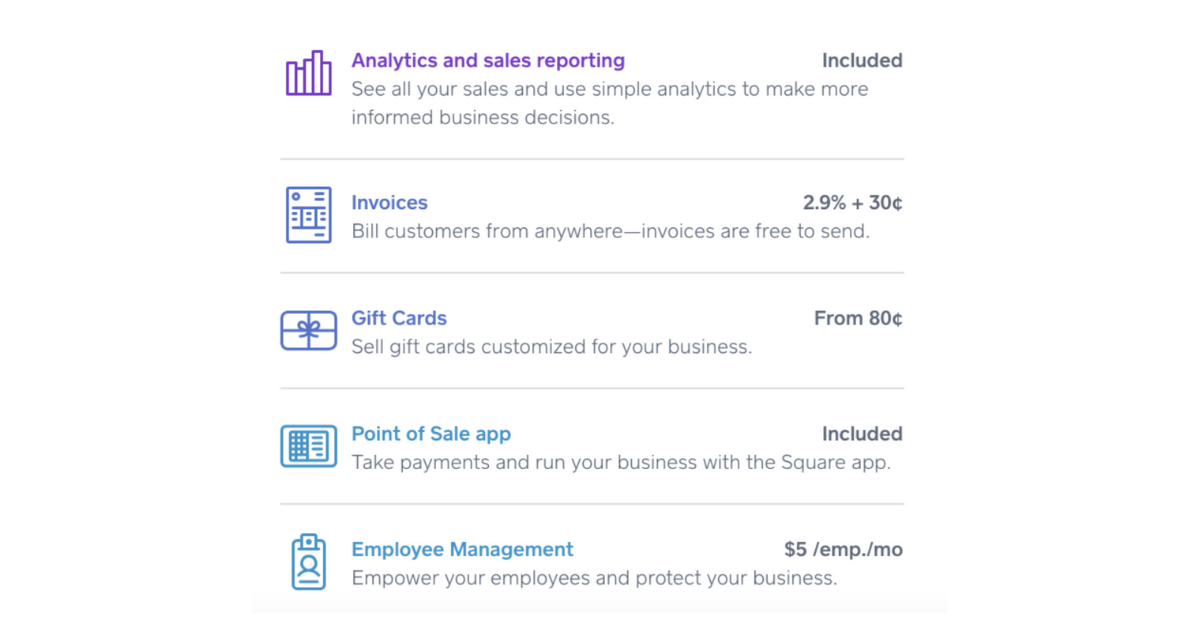

On the other hand, module-based pricing presents customers with additional modules that they can add onto their contract. Square’s module (& volume) based pricing can be found here and below. In any given month, customers can consume many different products (analytics, invoices, gift cards, etc) and at various volumes for each of those (invoices, gift cards, employee mgmt.). The result is that month-to-month gross margin (& the resulting LTV) is highly variable depending on how each individual customer performs.

Regardless of the approach between volume and module-based pricing, the key differences are; 1) the software is not sold by quota carrying BDRs and AEs, it’s sold through a beautiful website and product built with the intention of up-selling and cross-selling users and 2) the size of your customer contracts can range from very small to very large.

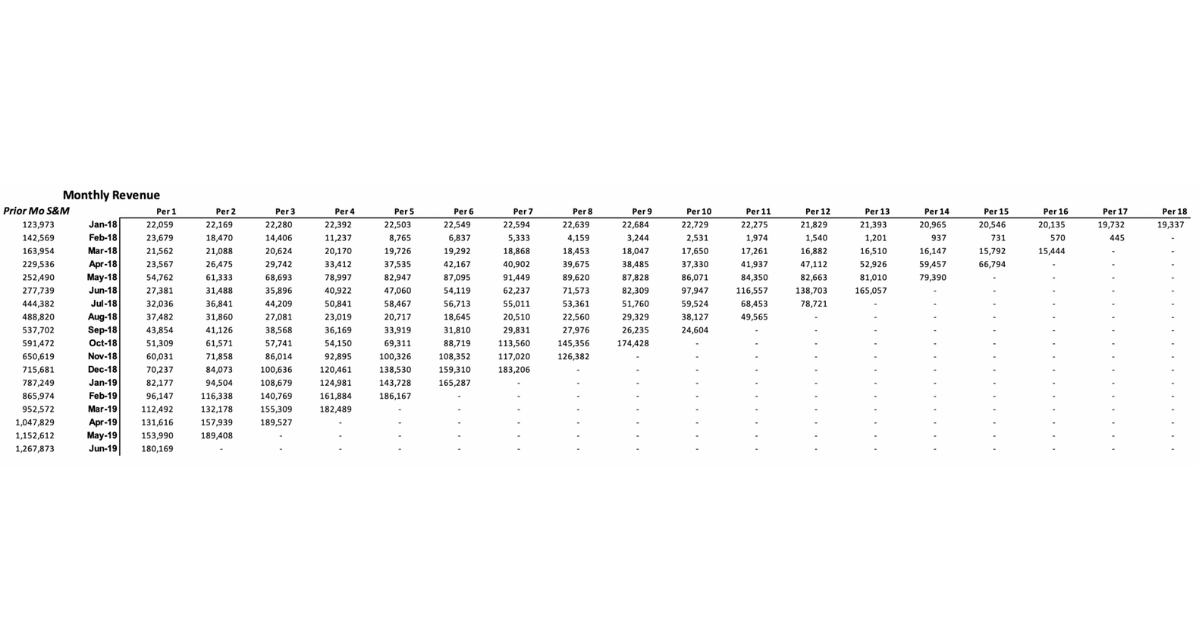

Given these changes to GTM motions and ARR schedules, what does this do to our LTV/CAC analysis? At its highest level, BDRs and AEs are replaced with Product Marketers, and annual revenue (and the resulting gross margin) is highly variable depending on how much churn, up-sell and down-sell happen month-to-month. The correct framework now becomes time to gross margin payback on a cohort basis. There are many ways to cut this data, but the two most important outputs are; rolling MRR by cohort, and total time to payback by cohort. You can find the complete analysis with a number of additional tables here.

The first table above is simple. It is monthly revenue over time by cohort. A great bottoms-up SaaS business will consistently have monthly revenue that is greater than the very first month of the cohort illustrating a situation where up-sell is greater than down-sell and churn. There will be bad months, and bad cohorts, but the hope is that over time, on average, the business grows on a cohort basis. You’ll notice above that the Feb 2018 cohort was in constant decline; it started in Period 1 with $23,679 in monthly revenue, and ended in Period 17 with $445 in monthly revenue. On the other hand, the June 2018 cohort started with $27,381 in monthly revenue, and ended Period 13 with $165,057 in monthly revenue.

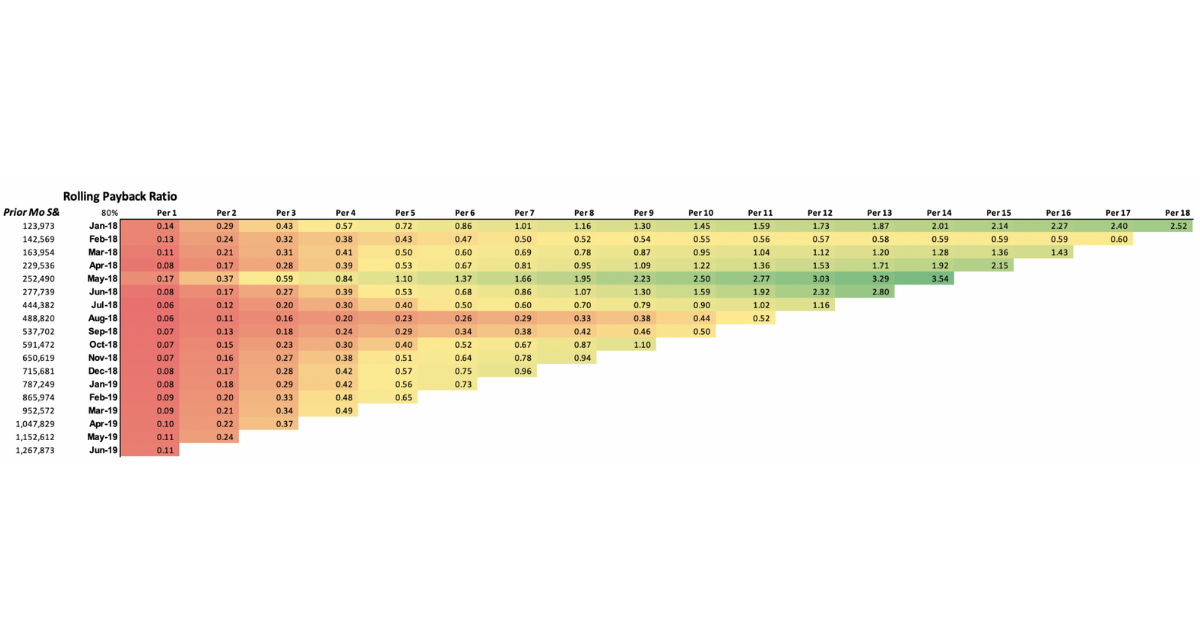

The second table above shows the total payback of the cohort relative to the entire sales and marketing spend from the month prior. In this example, I am assuming that there is a one month sales cycle for this business as is common for bottoms-up models. For example, for all of the customers that were acquired in the Feb 2018 cohort ($23,679 in monthly revenue), we are assuming that 100% of them were acquired with the prior months S&M spend which is $142,569 in this example. There are of course nuances here as out-of-home and other brand advertising techniques have long tail effects and you’ll need to amortize that spend over multiple periods when you run the analysis. Next, we apply the gross margin % (80% in this example) to that $23,679 monthly revenue to model out the monthly profit each cohort is providing to the business (Table 4 in the excel). Then, we simply take the cumulative gross margin by period to determine exactly when the business has paid back all of its sales & marketing expenses (CAC). In the second table right above here you’ll see that the March 2018 cohort had paid back 100% of its CAC (1.12 to be exact) by Period 12. By Period 16, that single cohort had paid back its CAC 1.43x over. The May 2018 cohort was even stronger having paid back its CAC 3.54x by Period 14 (a phenomenal cohort!).

In looking at these payback metrics you start to see why the LTV/CAC framework simply does not work with modern bottoms-up SaaS companies. The lifetime value of a customer can vary dramatically simply because the ACV range of possibilities is much higher given the pricing models above. Additionally, given the self serve nature of the product, CAC can range from very small, to very large. Imagine the scenario where someone from Walmart Corporate sees a single ad online, signs up for the product and then invites everyone on their team. Or the inverse where someone at a 10 person startup had to click on your ads for an entire year before converting. To illustrate this point, you’ll see that in Period 6 the cohort payback ranges from 0.26 to 1.37, and in Period 12, 0.57x to 3.03x; vastly different cohort compositions. Also note that it’s cohort payback and not customer LTV/CAC. In each of these cohorts, there are many customers that churned in early periods and on an individual basis were not profitable (poor LTV/CAC). That is ok as long as there are other customers in the cohort that expand over time.

This ability to expand is absolutely crucial to making these business models work given that consumer and SMB customers have a much higher propensity to churn relative to the enterprise users acquired in the same cohort. Additionally, the very nature and ease of on-boarding with new SaaS products means that it’s also much easier for a customer to churn and onboard with a new competitor. If you’re going to allow month-to-month contracts with low friction on-boarding (and churn!), you must have a product that lends itself to rapid growth either via volume or modules. Without large expansion potential your SaaS business is DOA.

The rule of thumb with legacy SaaS businesses is that you want to aim for an LTV/CAC of greater than 3x. Rules of thumb for bottoms-up businesses are dangerous because of the cohort composition ranging from consumer to SMB and enterprise. If you have 100% consumer in your cohort you better get paid back quickly because churn is high, and if the cohort has a majority of sticky enterprises then you may have more time.

One thing that is a constant in every business type regardless of model is payback. It still remains true that you always want to payback your acquisition cost within the first 12–18 months (shorter end for SMB, longer for enterprise). Additionally, you can keep it simple and say that the 3x target referenced in my original post remains the same. But, instead of LTV/CAC, that is now the minimum target cumulative cohort payback within the first 4 years. If your cohort composition skews more SMB, that number should be closer to 3 years, and for enterprise it can be extended towards 5.

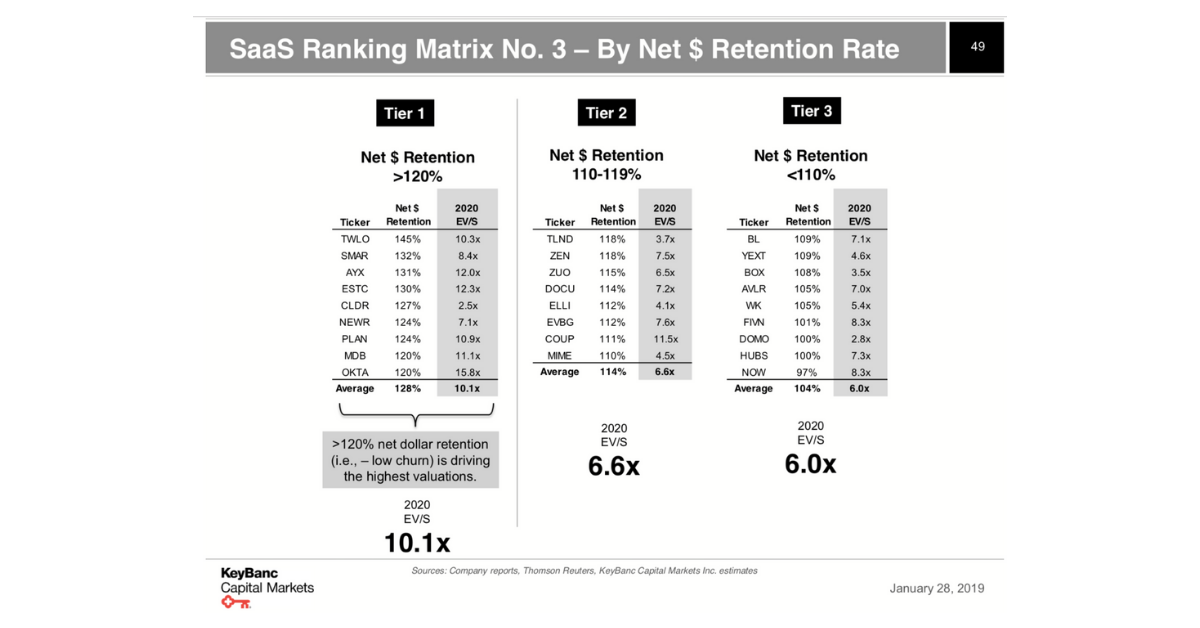

Best in class public SaaS companies are operating well above 100% net revenue retention which is directly correlated to CAC payback. If you take care of that along with healthy gross margins, the payback will follow. You’ll see below that investors are placing a huge premium on businesses with this type of retention behavior. Unsurprisingly, Twilio, a company that has mastered both volume and module based pricing (see here) is leading the way with 145% net $ retention.

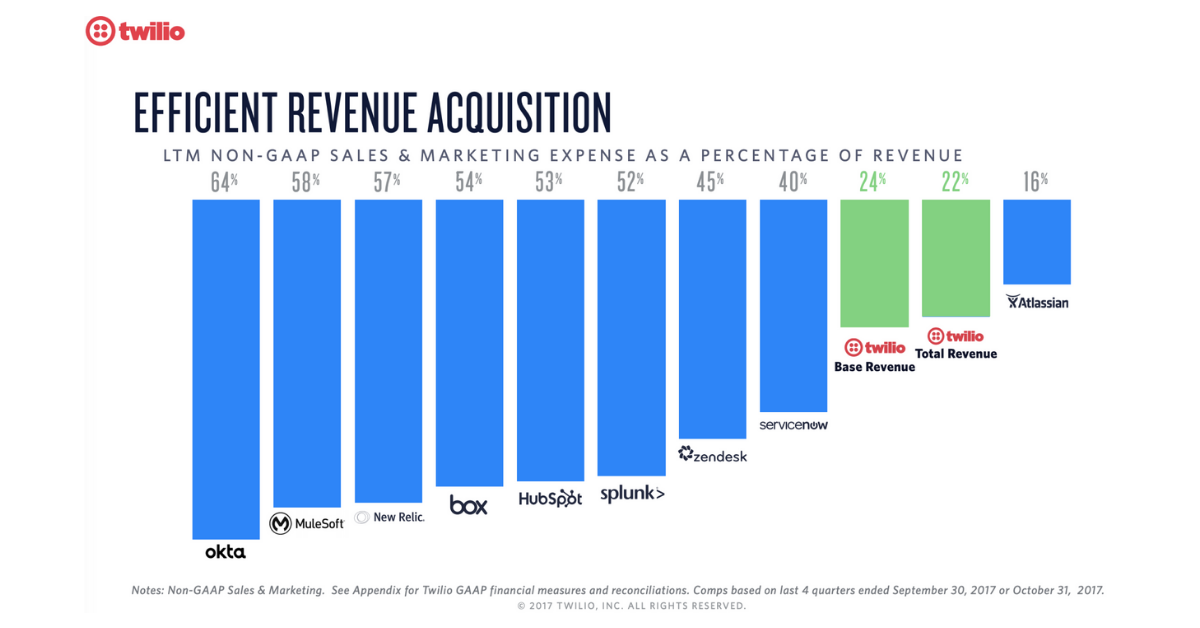

And better yet, they’re doing it with industry leading sales and marketing efficiency (notice another bottoms-up model is beating them in Atlassian).

At the end of the day, LTV/CAC and cohort payback methodologies are both determinants of cash flow health. If you remember the golden rule of financial analysis, everything else will take care of itself.

“Balance sheets and income statements are fiction, cash flow is reality”.

A few post scripts…

For the sake of outlining this analysis, I assumed this SaaS business GTM was 100% bottoms-up. In most cases, the best thing to do is complement the bottoms-up GTM with a traditional sales team for the larger and more complex logos. Ultimately this complicates the org (distinct customer success, website messaging, support, etc), and obviously the analysis, but this should be your north star.

I have long been arguing that at least a portion of the Product Marketing salaries should be included in CAC for bottoms-up models. This is simply a reallocation of legacy S&M spend, to product marketers for the explicit goal of driving more revenue and less churn. Founders and investors are not talking about this nearly enough today but I think it’ll be commonplace once bottoms-up GTM is truly the norm.

.jpg)