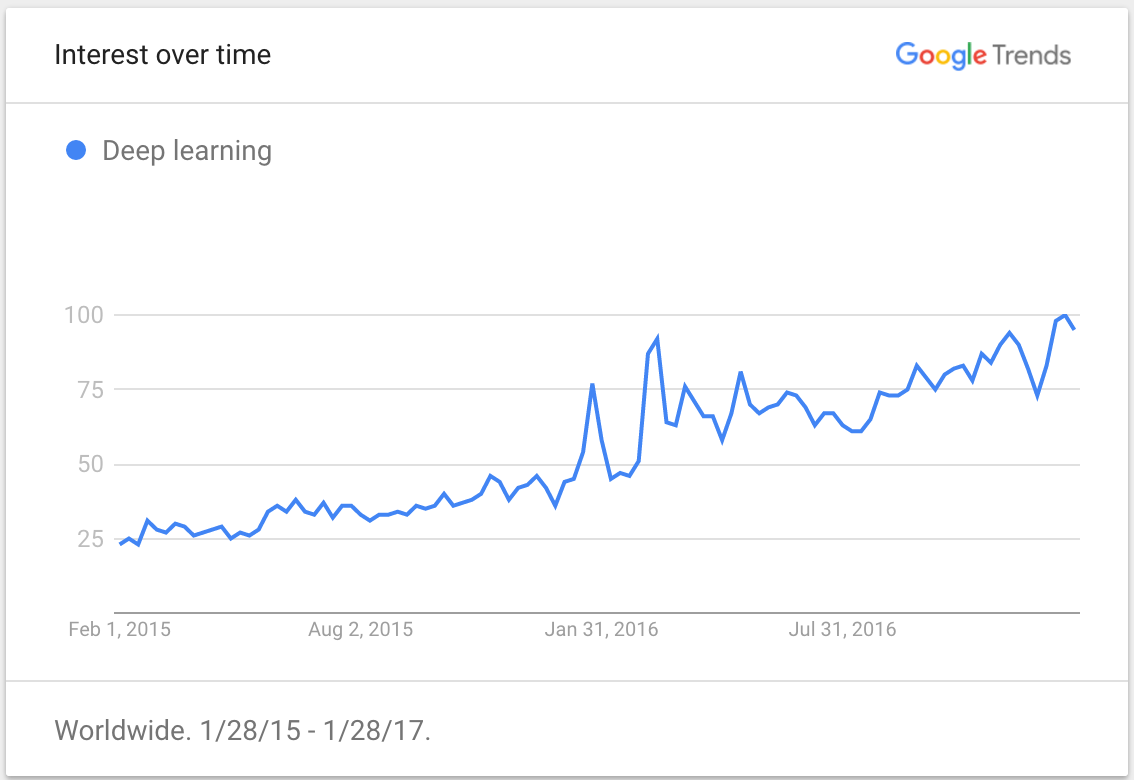

Artificial Intelligence (AI) is everywhere, from startups to enterprises, and even Hollywood. The search frequency of the term “Deep Learning” (DL) has grown 4x in the last two years. It seems to be the subject of every article (guilty), conference, and startup. It all feels a bit overhyped. Nonetheless, when you cut through this hype, AI is the next wave of innovation — and this is only the beginning.

Compounding Forces: Platforms, Algorithms, & Results

Over the last few years, we’ve seen the rapid development of AI platforms. Especially in the subfield of DL, where the differential equations behind backpropagation would make most developers’ heads spin, open source library TensorFlow empowers almost anyone to build the latest classifier and sophisticated conv-net. Today there are dozens of open source choices, ranging from university-led developments like Theano, Caffe, and DyNet, to company offerings such as TensorFlow, CNTK, and MXNet. As they compete to become the de-facto development platform, they push each other to improve functionality and feature sets. This competition is actually a Trojan horse within the enterprise. As these platforms become easier to use, AI will become more and more central to the enterprise.

As algorithms move from classical rules-based AI (Expert Systems), to regressions (Machine Learning), to multi-layered nets (Deep Learning), to now Reinforcement Learning, we see new ways for AI to permeate the enterprise. For example, Deep Learning has redefined fields using unstructured data (i.e., computer vision and speech). Reinforcement Learning has even broader applicability, ranging from time-series data fields like finance and security, to multi-step processes like robotics and logistics. The race is on for startups to deploy the next generation of algorithms and create a defensible moat of proprietary data and models. Ready. Set. Train!

The result? AI is, for the first time at scale, delivering real results in real products and services. Companies like Google, Facebook, and Baidu have embraced the spirit of applied research within the enterprise with people like Geoffrey Hinton, Yann LeCun, and Andrew Ng. Jeff Dean recently talkedabout the increased use of AI within Google — not just in research, but in production. In many ways, this parallels the software movement two decades ago — the successful companies embraced this new paradigm and thought of their business as software-first. A decade ago it was mobile-first. The next generation of successful companies will be AI-first.

Investing Through the Hype

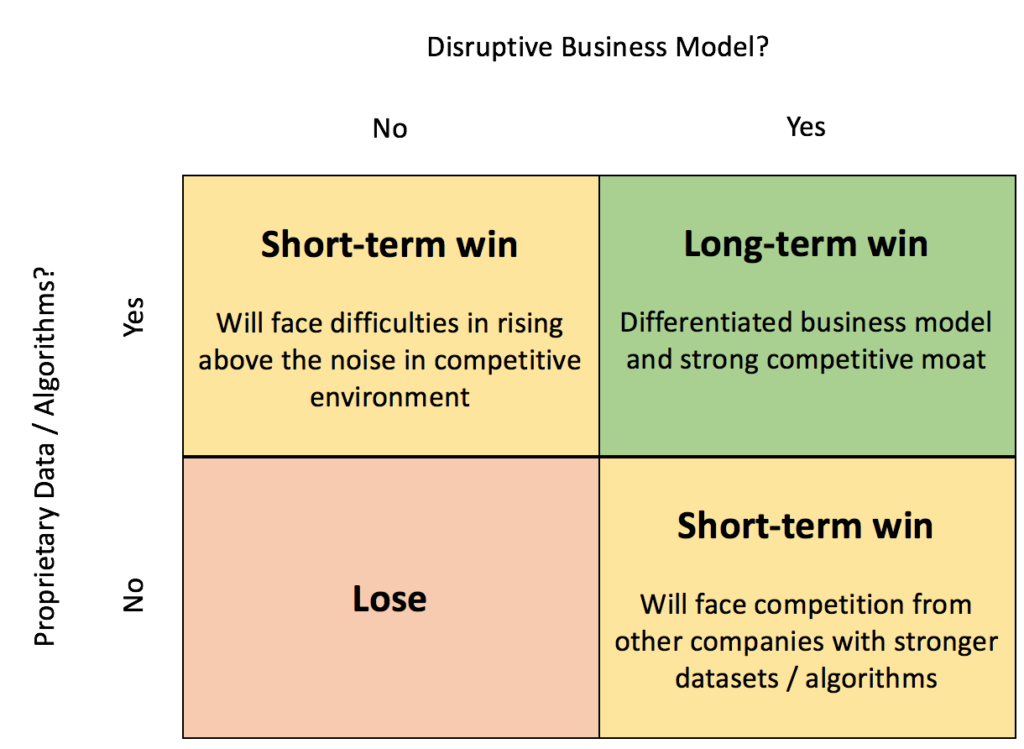

There is no shortage of startups claiming to be AI companies. The challenge that investors — and founders face is cutting through the noise to determine what really is an AI company. This is especially true for companies building AI solutions at the application-level, which is where Canaan is focusing our time and dollars. In order to sift through the hype, I use a simple 2×2 framework to assess the potential of AI startups. On one axis, I look for companies that have a differentiated data set (i.e., uniquely labeled data, proprietary data) or algorithms, which will allow them to build a long-term competitive moat as they better train, process, and improve their model. The second, equally important factor is business model innovation. In particular, I am excited when I see companies building AI-centric applications that are fundamentally disrupting industries with manual, time-consuming processes. If companies excel along one axis but not the other, they may enjoy short-term success, but competitors with better data or unique business strategies will capitalize on their weakness and soon supplant them. The next generation of winners in AI will excel along both axes. Not only do they change the way an industry views their business, but by the time the competition figures it out and tries to challenge them, it will be too late to break the AI-first company’s defensive moat of better data and algorithms.

Ladder, a recent addition to the Canaan portfolio, is an example of a company that excels on both these fronts. They have differentiated data sets and unique AI models to underwrite term life insurance in real-time rather than the industry average 6–8 weeks to process an application. This vastly expands the accessibility and ease of buying this important product. And as they continue to ingest more data from their consumers, their real-time underwriting models continue to exponentially improve. Data moat? Check. Business model disruption? Check.

End Game: Democratization of AI

We are entering a critical inflection point in the AI ecosystem. The simultaneous forces of platforms, algorithms, and results are not isolated. They are deeply connected and create a viral network effect with each other. It’s still early days (despite all the hype). The majority of value creation in this nascent industry is still to come. But there is no question the potential and vast reach of AI is real. At Canaan, we’re looking to invest in startups that leverage AI to disrupt archaic business models with new and unique data. If that’s you, let’s chat (bot).